how to lower property taxes in nj

Want to Lower Your Property Taxes. The highest top tax rates on individual and corporate income in the developed world.

Property Taxes Property Tax Analysis Tax Foundation

The County Assessor determines each propertys the full and fair value as if it were to sell in fair and bona fide sale by private contract on the October 1 preceding the date the assessor completes the assessment list.

. Payments must be received on or before February 10 th to avoid interest in accordance with New Jersey State Statutes. Therefore looking at specific counties will give you a better sense of how high property taxes can actually get. Whether you have a 10000 or 1000000 house you will owe real property taxes in Florida.

There is no minimum or maximum of real property taxes you could owe in Florida. But its still lower than the top income tax rates in California and Hawaii. On a 327700 house the median home price for Q1 2021 in NJ that means 675 per month and 8108 per year in property taxes.

Property taxes in the Garden State are the highest in the nation however with an average effective. ATTOM Data Solutions reports that the counties with the highest effective tax rate as of 2020. While it can help to consider state averages property taxes are typically set at the county level.

7 Steps to Appealand Win By Stephanie Booth. One way to lower your property tax is to show that your home is worth less than its assessed value. You can do the initial research online in just a few minutes or by making a quick call to your real estate agent.

In New Jersey the median property tax rate is 2471 per 100000 of assessed home value. Several other states many of which are located in the South have property tax rates under 1. The New Jersey County Tax Boards Association established that all real property be assessed at 100 of market its value.

For your convenience there is a mobile payment drop box located on the island in the lower level. The new program would lower the effective average property tax cost back to 2016 levels for many households that have been ineligible for. Take a state like New Jersey where homeowners pay an average property tax rate of 247 for 2021.

The Highest Property Taxes by County. If approved you could be eligible for a credit limit between 350 and 1000. Median household income owner-occupied homes.

But the state also makes additional property tax relief programs available to certain groups. REMINDER FROM THE TAX COLLECTORS OFFICE Just a reminder that 1 st quarter property taxes are due February 1 2021 with a 10 day grace period. Effective property tax rate.

New Jersey taxes are among the highest in the nation. The County Assessor determines each propertys the full and fair value as if it were to sell in fair and bona fide sale by private contract on the October 1 preceding the date the assessor completes the assessment list. Property taxes help finance the salaries and supplies for firefighters police EMTs and a range of public safety.

And if you live in a high-tax stateNew Jersey Illinois and Texas. The NJ homestead rebate program can provide property tax relief to lower-income homeowners. Median property taxes paid.

Should certain groups of people be exempt from property taxes or be taxed at a lower rate. A lower court has ruled the tax is unconstitutional but an appeal is expected. Lyndsey Rolheiser Assistant Professor Finance School of Business University of Connecticut Read More.

President Bidens budget proposes several new tax increases on high-income individuals and businesses which combined with the Build Back Better plan would give the US. Heres how to appeal your property tax bill step by step. Bidens FY 2023 Budget Would Result in 4 Trillion of Gross Revenue Increases.

The top tax rate in New Jerseys progressive state tax system is 1075 for those over 5 million. The New Jersey County Tax Boards Association established that all real property be assessed at 100 of market its value. Check cashing not available in NJ NY RI VT and WY.

Hawaii has the lowest effective property tax rate at 031 while New Jersey has the highest at 213. Effective property tax. Here are the small and midsize cities with the highest property taxes.

Qualifying homeowners who are 65 and older or who are disabled can get up to 250 deducted from their property tax bills. Read Your Assessment Letter. The New Jersey Division of Taxation manages the administration and collection of taxes and related programs for individuals and corporations in the stateGenerally you have to file a state tax return if youre an income earning resident or part-year resident or a non-resident who earned income over a prescribed income threshold in the state.

Large cities with the highest property tax rates. Minimum monthly payments apply.

Property Taxes By State Embrace Higher Property Taxes

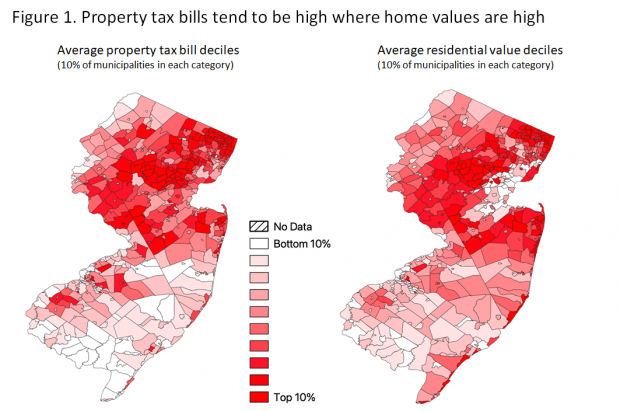

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Property Tax Reduction Should You Hire An Expert Tax Reduction Property Tax Tax Consulting

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Deducting Property Taxes H R Block

Property Taxes Property Tax Analysis Tax Foundation

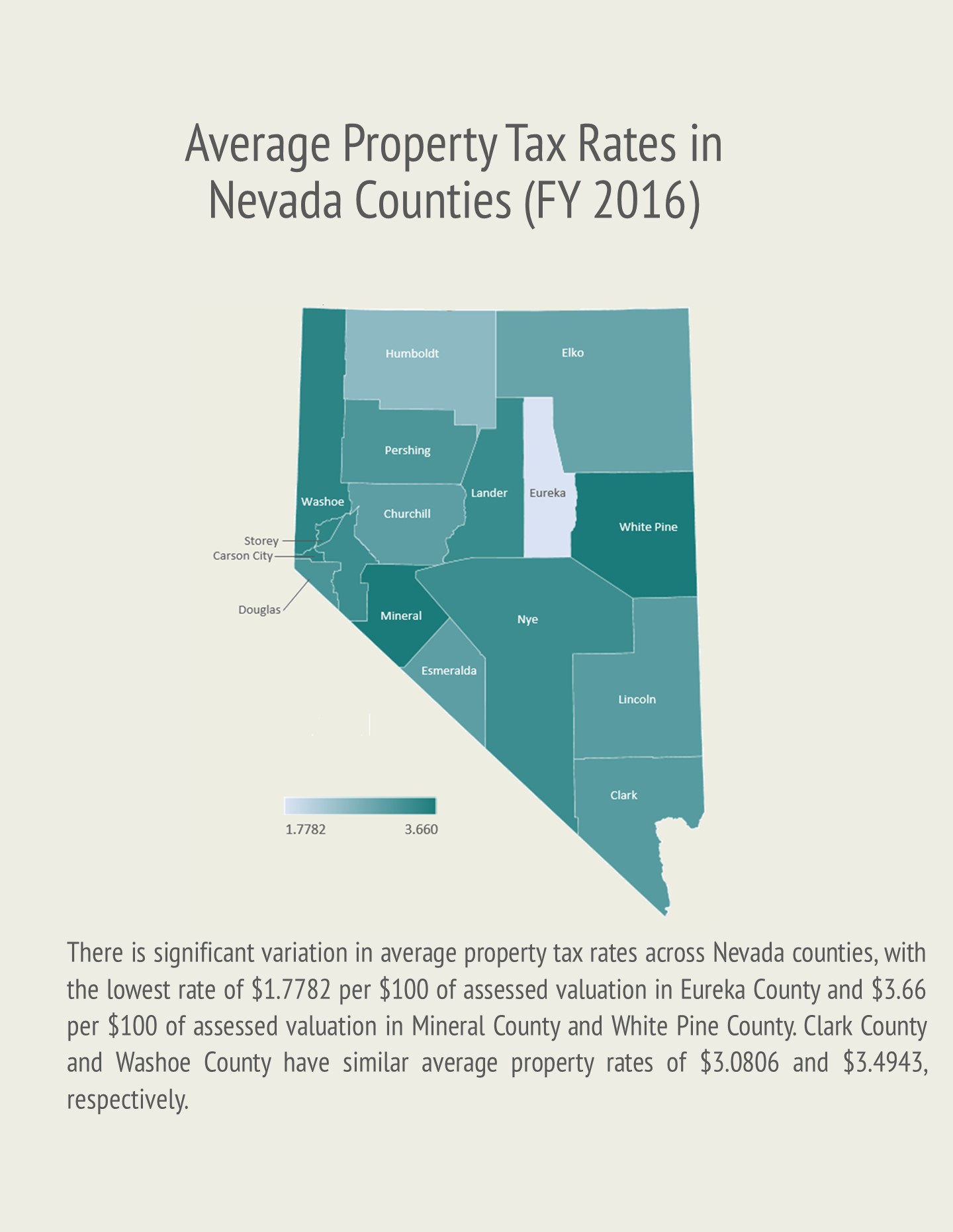

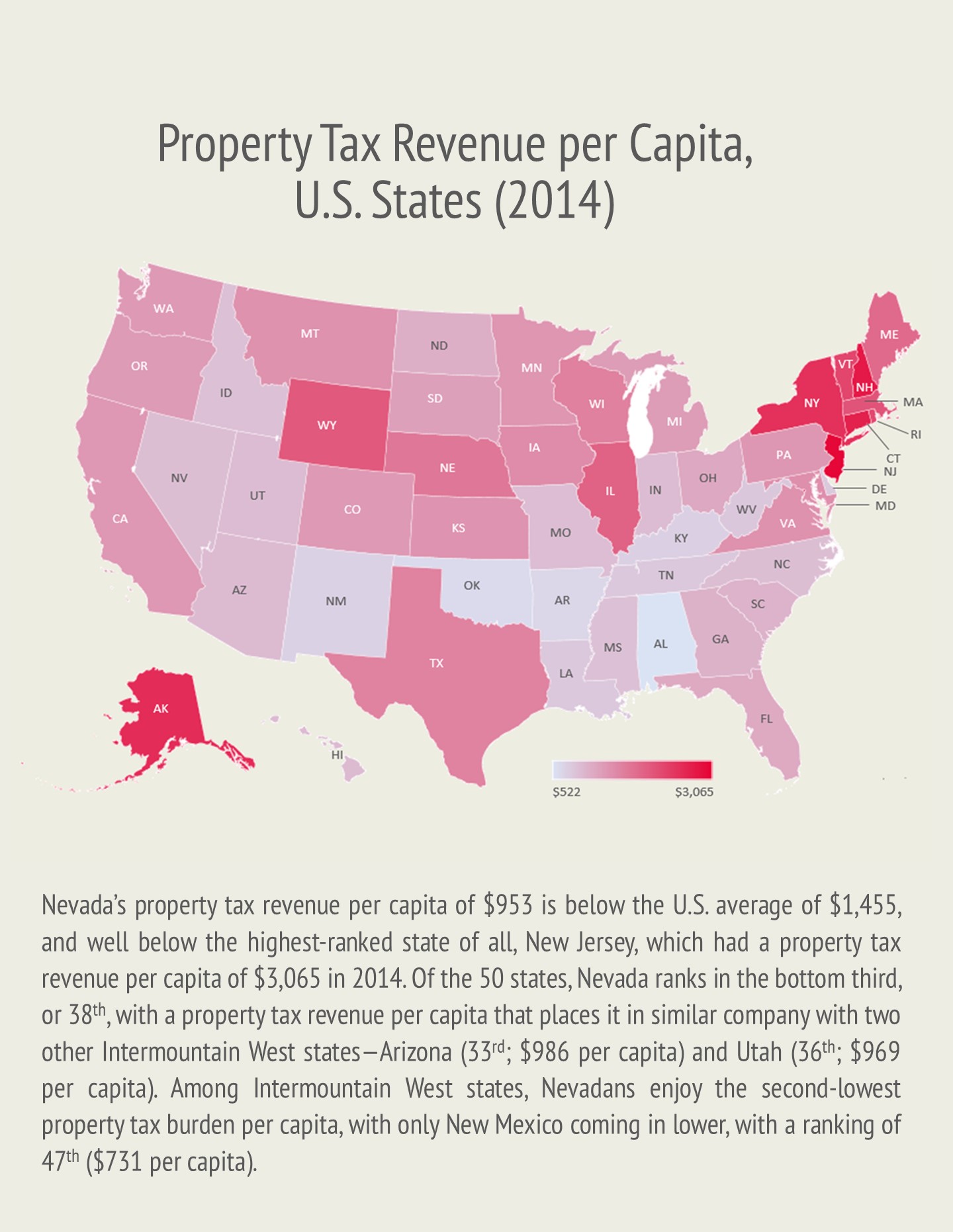

Property Taxes In Nevada Guinn Center For Policy Priorities

Florida Property Tax H R Block

Nutley Real Estate Homes For Sale Information About Nutley Nj Real Estate Real Estate Tips Real Estate Nj

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Pin On Real Estate Investing Tips

How To Lower Your Property Taxes Youtube

Property Taxes In Nevada Guinn Center For Policy Priorities

Property Tax How To Calculate Local Considerations